Over 37 million marginalized Americans live in poverty, and nearly 50% all US adults lack basic financial literacy. I took on the challenge of providing an easy and organized financial learning platform concept. As a result I designed Investify, which focuses on community-based education, mentorship, and expert guidance for poor marginalized communities.

My Role

Product designer

UX researcher

Interaction designer

Problem

During the research I discovered that that the financial industry is constantly evolving with complex regulations, making it hard for people to stay updated. Additionally, there is a lack of dedicated platforms for financial education, forcing people to rely on fragmented sources and personal connections for guidance. Connecting with experts and volunteer organizations is also challenging, further hindering people's ability to improve their financial well-being.

Solution

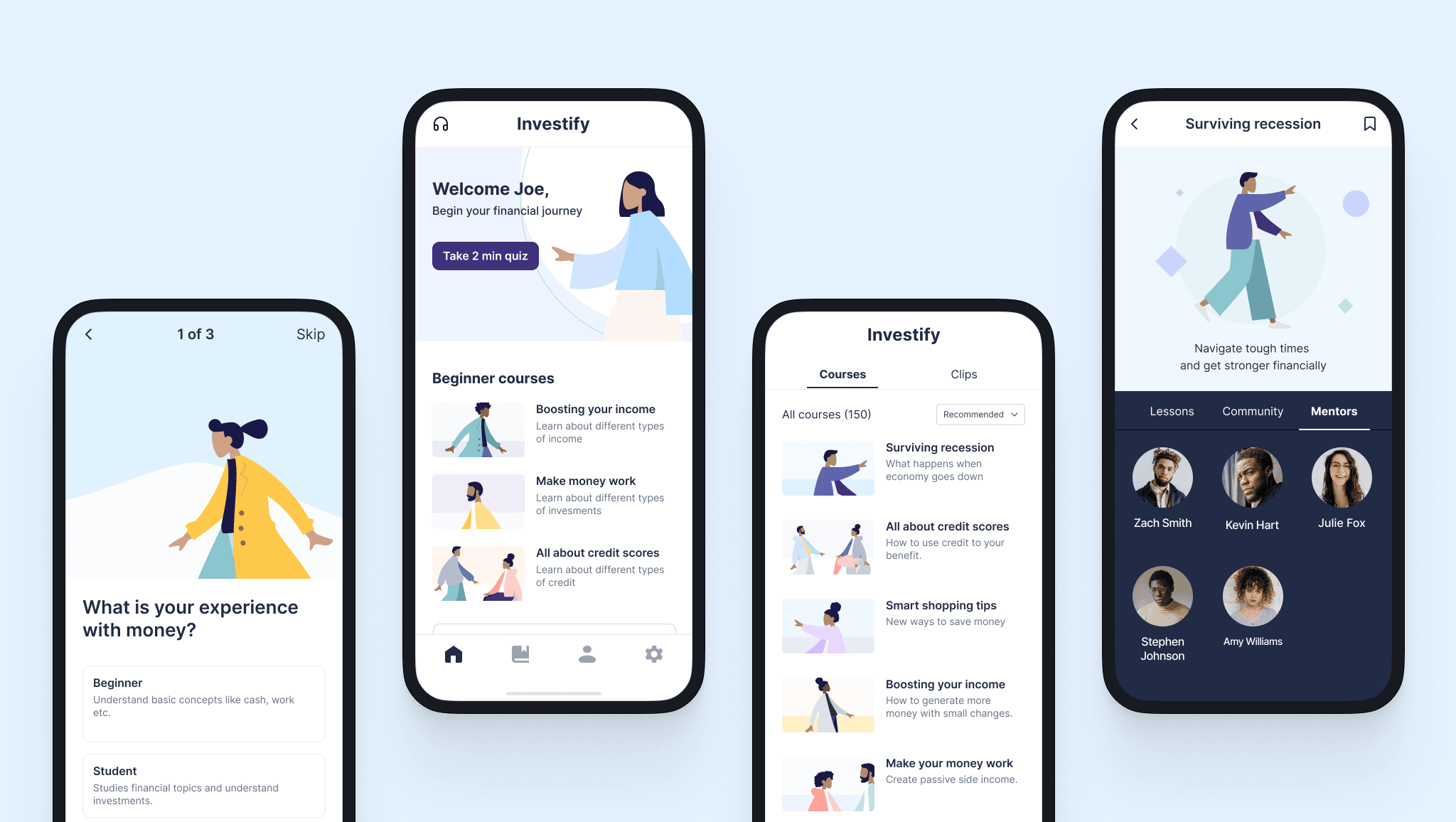

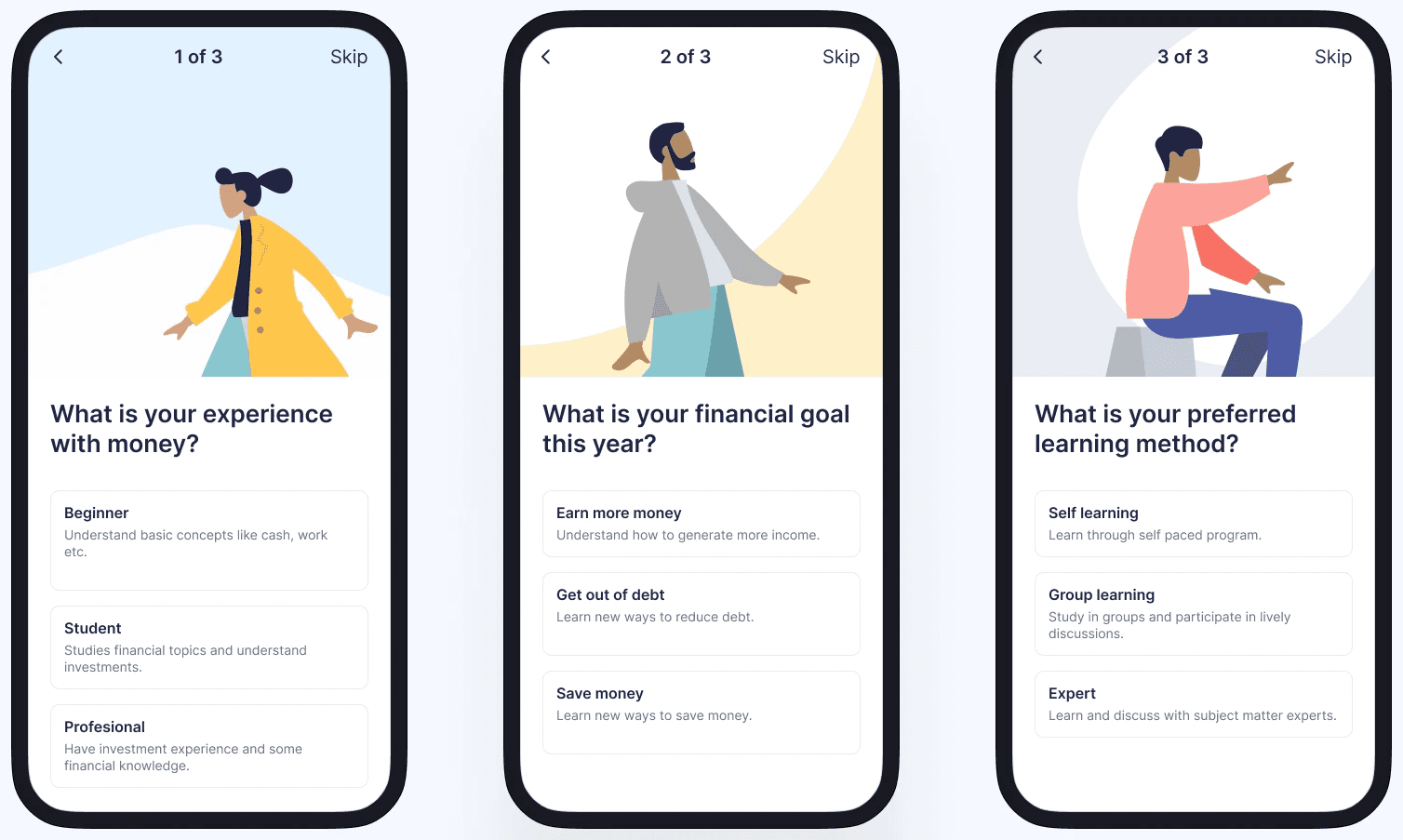

A simple and short onboarding process helps get essential information about the person's financial knowledge, risk tolerance and preferred learning style. Providing personalized content we learned was important to motivate and engage people.

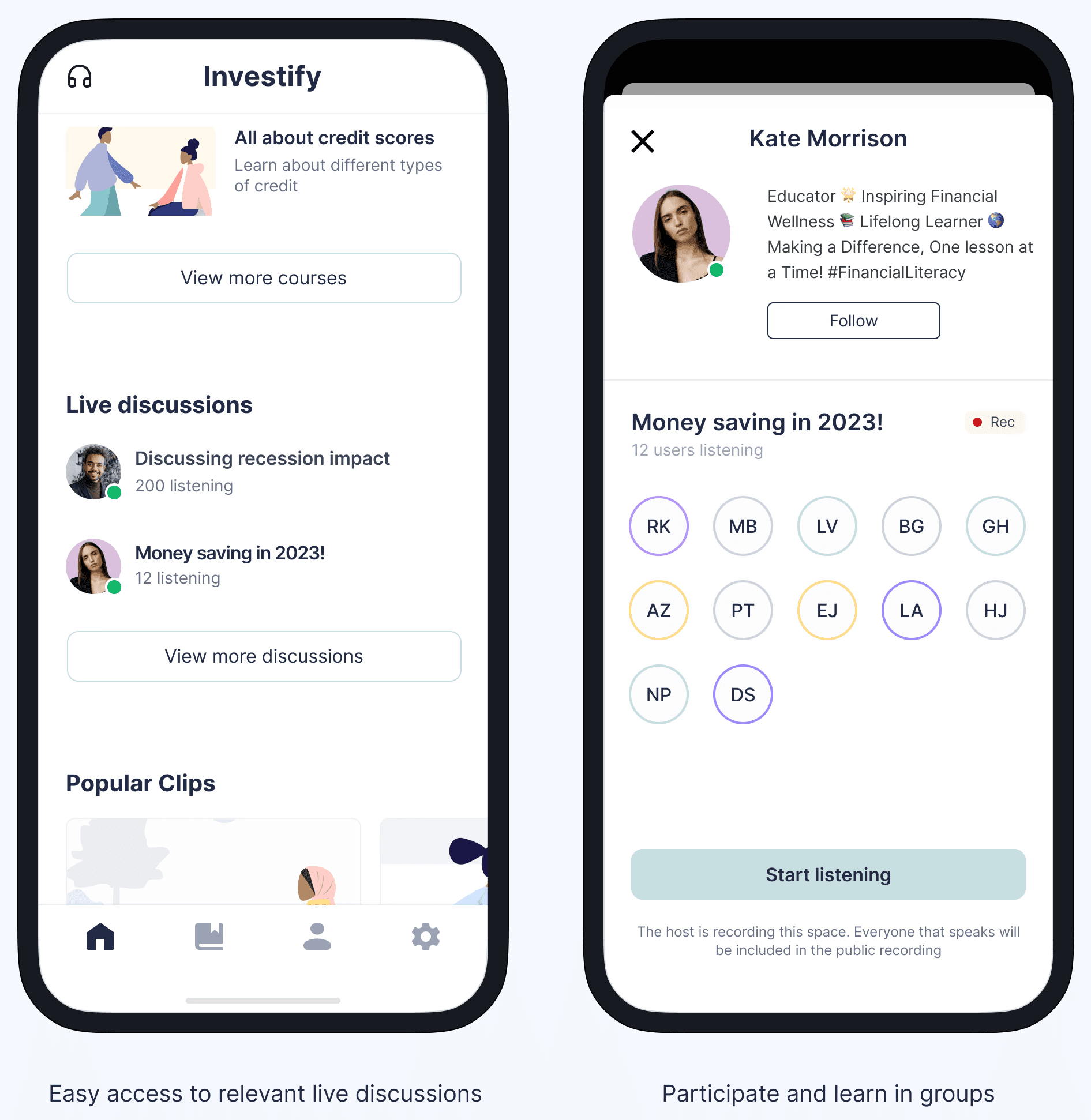

I discovered via my primary research that people find it easier to grasp complex financial topics when learning within groups, this provides them with connection and support. To support diverse learning styles people can access community events and engage with other people and experts offline.

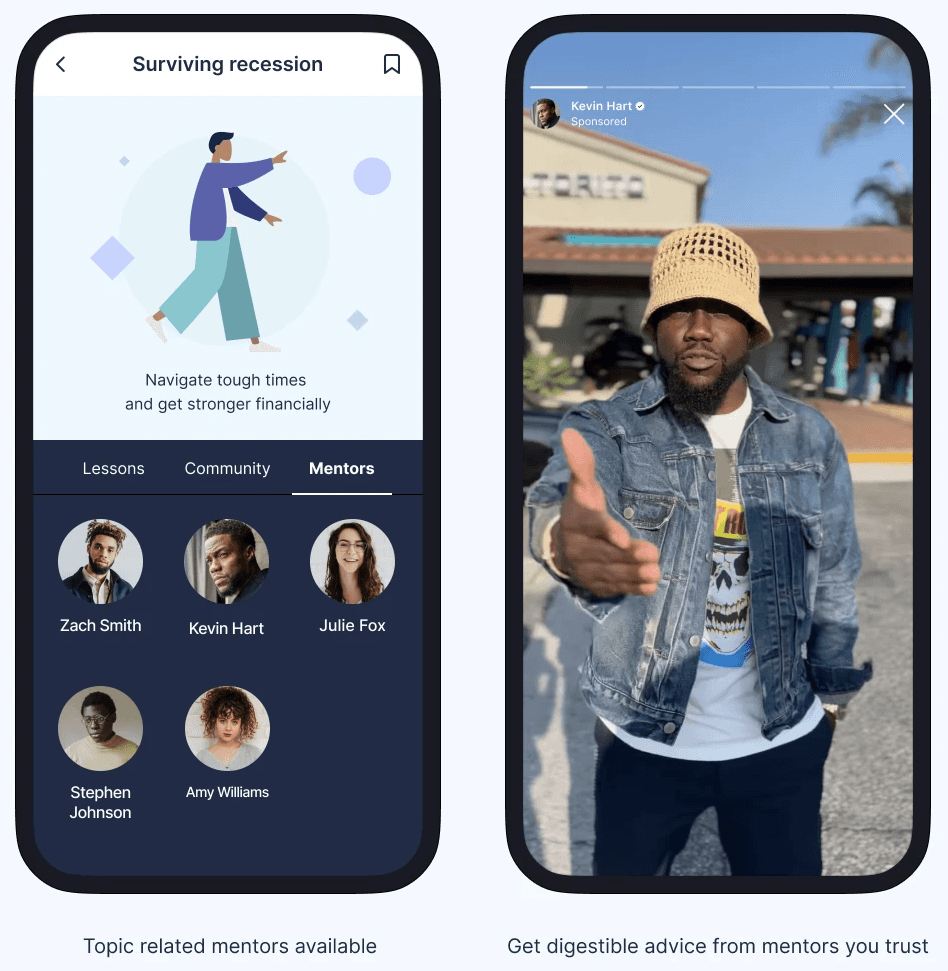

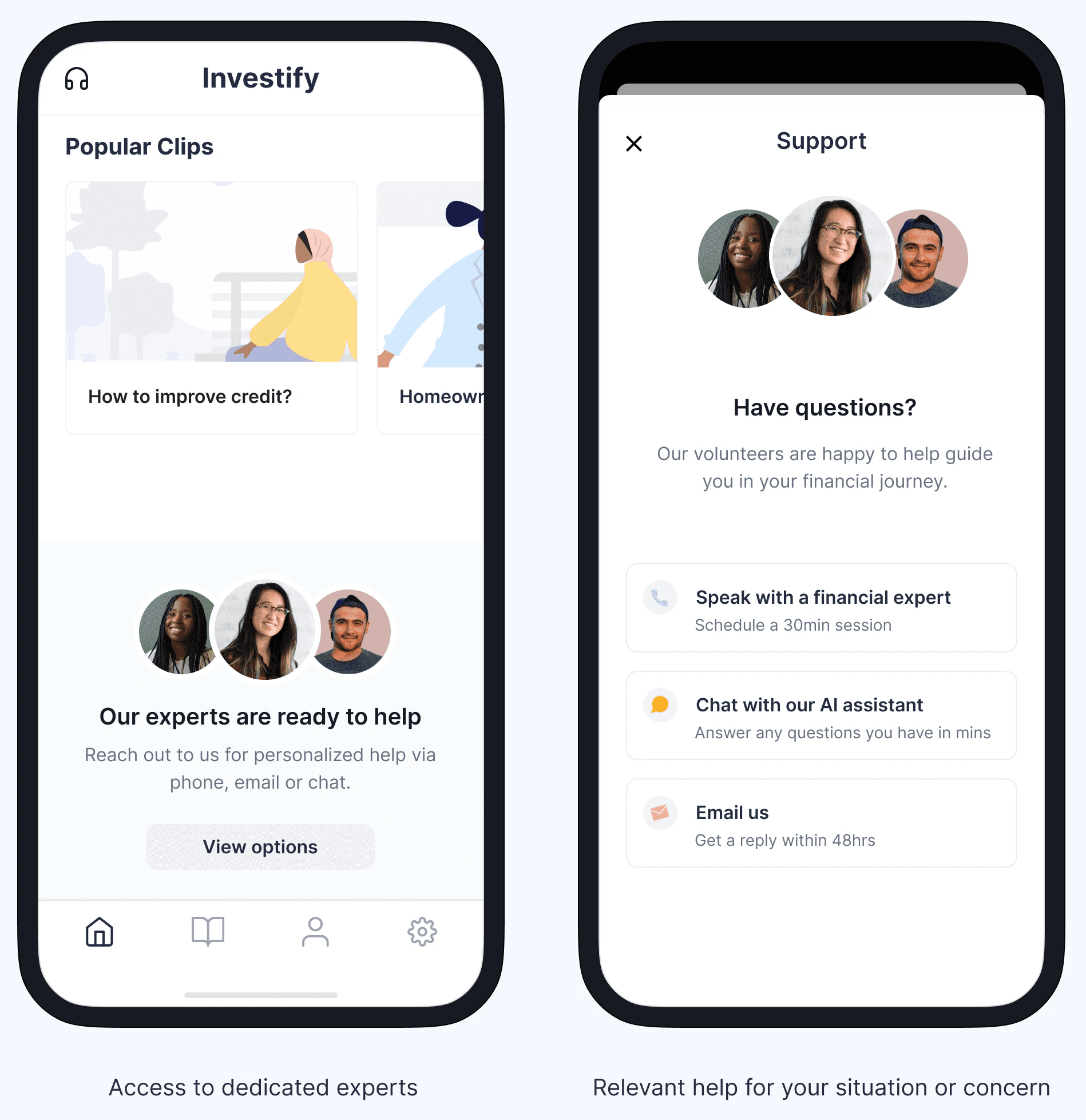

Access to credible financial experts and mentors

Creating meaningful change in user behavior requires dedicated support around people's unique financial situation. Providing easy access to live mentors who can connect on a 1:1 call to give guidance is key. People feel more confident about creating real impact on their financial future with personal credible support.

Take Aways

Continuously seeking and iterating on user feedback will ensure that the app remains user-centric and continues to meet the evolving needs of its target audience.

User Satisfaction Score

of users would promote, and recommend the app to others.

Behavioral Impact

users would actively use the app to improve their financial literacy